Big banks may be losing share of the mortgage market but they continue to hold mindshare when borrowers shop for mortgages. While specialized mortgage banks have experienced significant growth over the past several years, most mortgage borrowers still turn to big banks when they compare lenders according to the FREEandCLEAR Mortgage Survey.

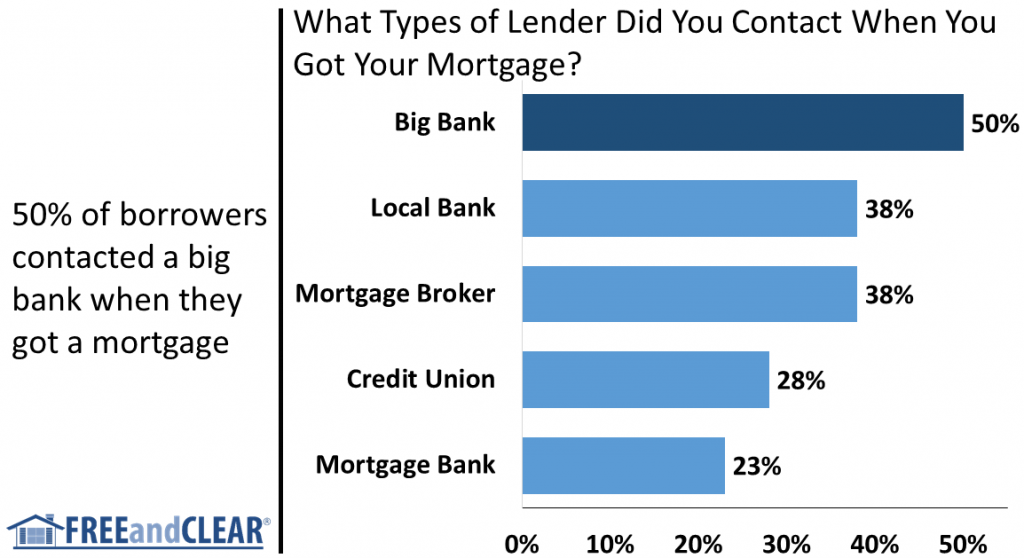

When asked “what type of lenders did you contact when you got your mortgage (select all that apply)?”, 50% of borrowers selected “Big Bank”, which ranked as the top survey response. Given the tarnished reputation of big banks as well as recent scandals, we were somewhat surprised that borrowers selected big bank more than any other type of lender. The high ranking for big banks is likely attributable to borrowers having existing checking or savings account relationships with the banks as well as borrowers wanting to get a mortgage quote from a known brand.

The surprising results extended beyond the top of the survey as smaller, local lenders placed relatively high. “Local Bank” and “Mortgage Broker” tied for the second highest response, with each type of lender garnering 38% of borrower responses. Industry regulations implemented since the mortgage crisis have made business more challenging for both smaller lenders and mortgage brokers but they continue to be an important resource for borrowers and more importantly, a viable lending option. The results of the FREEandCLEAR Mortgage Survey suggest that borrowers like having multiple lender choices — both big and small — when they shop for a mortgage.

The bottom results of the survey are also highly informative with “Credit Union” and “Mortgage Bank” ranking fourth and fifth, respectively. 28% of borrowers said that they contacted a credit union when they got a mortgage, which is roughly consistent with credit unions’ share of the overall mortgage market. As credit unions continue to grow their membership bases and expand their mortgage lending options you would expect them to increase their borrower mindshare in the future.

Perhaps the most surprising finding from the survey is that only 23% of borrowers said that they contacted a “Mortgage Bank” when they got a mortgage. Mortgage banks that focus exclusively on mortgages without taking borrower deposits or offering other lending products have gained significant market share over the past half decade. Despite their strong growth, mortgage bank attracted the lowest response rate among surveyed borrowers. There are several possible explanations for why mortgage bank ranked so low. First, because the definition of a mortgage bank is relatively technical, borrowers may not differentiate between a mortgage bank and other types of lenders when they shopped for their loan. We hypothesize that a higher percentage of borrowers contacted mortgage banks without actually realizing the lender was a mortgage bank.

The second factor that contributed to the disconnect is that while fewer borrowers may shop mortgage banks, more borrowers may select them for their loan. For example, a borrower may not contact multiple lenders before deciding to use a mortgage bank for their loan. Larger mortgage banks tend to advertise heavily which may attract more customers directly. While FREEandCLEAR advocates that borrowers always shop multiple lenders for a mortgage, some borrowers may be persuaded by a lender’s marketing messages. Whatever the reason, we expect mortgage banks to attract a greater share of mortgage shoppers in the future.

While the mortgage lender landscape continues to shift, the results of the FREEandCLEAR Mortgage Survey reinforce how important options are for borrowers. Whether borrowers contact old school big banks, local banks or mortgage banks, the ability to shop multiple types of lenders remains key to borrowers finding the mortgage that is right for them.

We will continue to provide a detailed analysis of each survey question on our blog in the coming weeks and you can review the full results from the FREEandCLEAR Mortgage Survey to better understand how borrowers think about and experience the mortgage process.