How Borrowers Find a Mortgage Lender

It seems like the Internet is replacing traditional methods of shopping in almost every area of commerce. Whether its groceries, clothes, electronics, travel, cars, real estate and just about any product you can imagine, people are turning to the Internet to search for, research, compare and buy products and services.

At FREEandCLEAR we want to understand how this tidal wave of online shopping is impacting how borrowers search for and select their mortgage lender. Is the mortgage market similar to other industries where we would not think of making a purchase without first researching our options online? I mean, who would buy an airline ticket without checking out an online travel website to compare flight prices. Where we used to turn to a travel agent to book our flights (remember when), we now turn to the Internet. Online shopping has fundamentally changed the way we shop for travel and so many other products and services, but what about mortgages? Has technology replaced people and relationships when it comes to finding a mortgage lender?

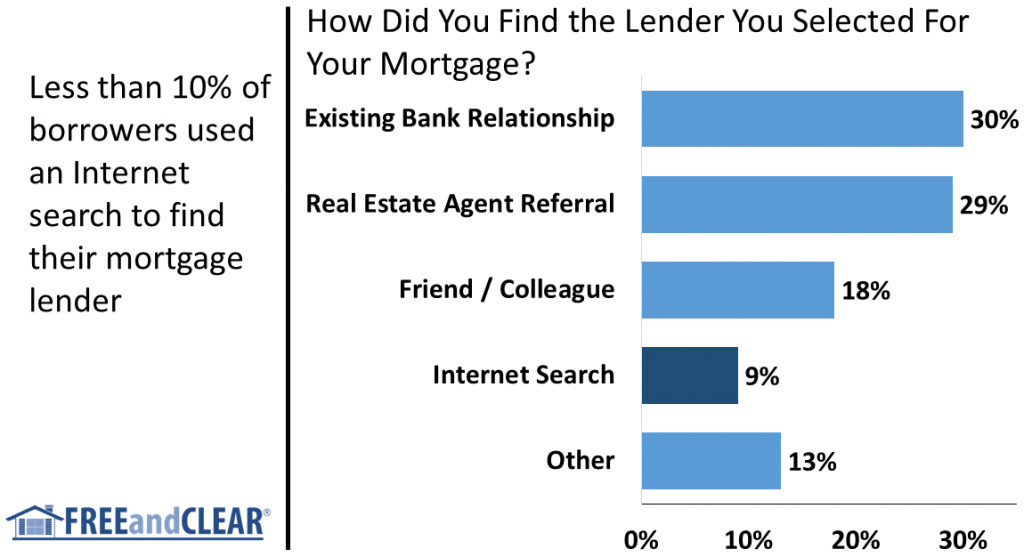

According to the surprising results of the FREEandCLEAR Mortgage Survey, the answer is a resounding no. Based on our findings, the mortgage industry is one of the last remaining market segments where relationships, not technology, drive the selection process. When asked how did you find the lender you selected for your mortgage, 30% of borrowers selected an existing bank relationship, 29% of borrowers selected a real estate agent referral and 18% selected a friend or colleague. So in total, 77% of survey respondents indicated they relied on a personal relationship to find their mortgage lender — an astoundingly high figure when compared to other product and service categories that seemed to have been overtaken by the Internet.

Perhaps what is most shocking about the FREEandCLEAR Mortgage Survey is how low the Internet ranked in the results as only 9% of borrowers selected Internet search when asked how they found their lender. Based upon these findings, relationships outweigh technology when borrowers select a mortgage lender by an almost almost 9-to-1 margin. Compared to other product and service categories where technology is replacing people, it seems that borrowers still prefer “old school” methods when selecting a lender. Whether it is with your bank, real estate agent, friend or business colleague, relationships still matter when it comes to mortgages.

The survey results are fascinating and raise the important question of why the Internet and online shopping has not transformed the mortgage market as it has so many other areas of our lives? What is it about mortgages that leads people to rely on relationships instead of the Internet when they make a purchase decision?

Our hypothesis is that the complicated and sometimes overwhelming nature of the mortgage process leads borrowers to seek more personal approaches to finding a lender. Mortgages are far more complex than commodity products like airline tickets so maybe it should not come as a surprise that borrowers rely on relationships when they “shop” for lenders. While you may be comfortable using the Internet to shop for a new television, getting a mortgage can be confusing and it is not something most people do on a regular basis. Plus, a mortgage is a lot more money than the price of an airline ticket or television.

While websites like FREEandCLEAR and others are making it increasingly easy to compare mortgage lenders, people will always play an important role in the lender selection process. As more millennials buy homes we expect that more borrowers use the Internet to shop for mortgage lenders but use technology to complement, not replace, our trusted relationships.

We will continue to provide a detailed analysis of each survey question on our blog in the coming weeks and you can review the full results from the FREEandCLEAR Mortgage Survey to better understand how borrowers think about and experience the mortgage process.

%