How Knowledgeable Are Mortgage Lenders?

The turmoil in the mortgage market over the past several years resulted in significant personnel turnover at lenders. Many lenders ceased operations and droves of experienced mortgage professionals changed careers or retired in response to the industry downturn.

At the same time many mortgage veterans were leaving the industry, new rules and regulations were adopted that made the mortgage process more complicated. We are all familiar with borrower anecdotes about loan officers that did not know what they were doing, leaving us to question if the “brain drain” of knowledgeable professionals has negatively impacted the mortgage experience for borrowers.

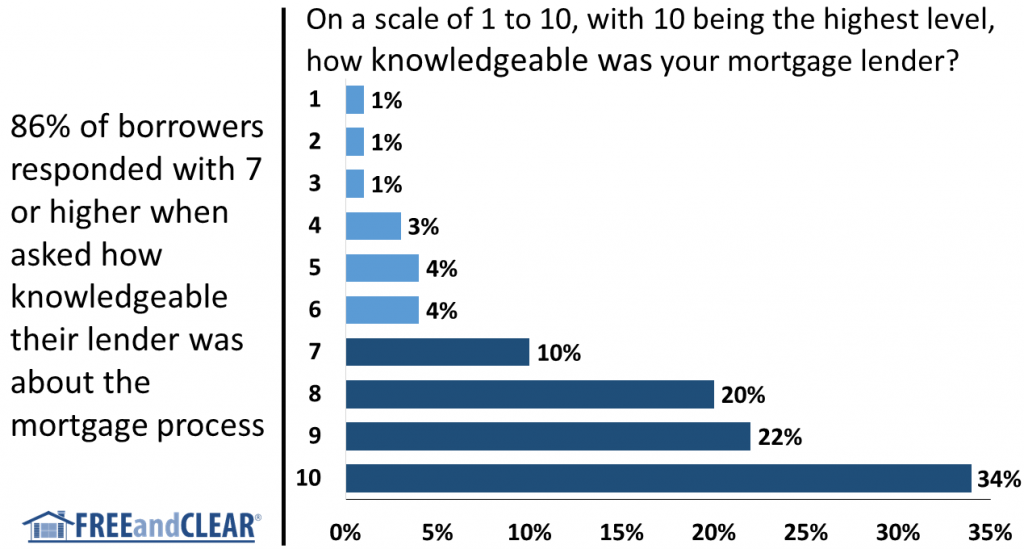

The FREEandCLEAR Mortgage Survey explored this issue and attempted to quantify if negative borrower experiences with mortgage professionals were the rule or the exception. We asked borrowers to rate how knowledgeable their lender was about the mortgage process on a scale of one to ten, with ten being the most knowledgeable, and the results reflected very positively on today’s mortgage lenders.

The survey showed that an astounding 86% of respondents selected seven or higher when asked how knowledgeable their lender was. The highest rating option of 10 led the way with 34% of borrowers followed by 9 with 22% of borrowers and 8 with 20% of borrowers. In fact, the five highest rating options garnered the top five borrower responses, in order.

So despite all the changes in the mortgage industry and outflow and inflow of professional talent, most borrowers think their lender is pretty smart when it comes to the mortgage process.

The positive borrower sentiment could be attributable to several factors. First, many of the most experienced mortgage professionals managed to survive the market swings and remain in the industry. Second, many high-quality professionals have returned to the industry as the mortgage market has rebounded. Finally, new licensing rules require more ongoing lender training and education. While these regulations may be a pain, perhaps they have produced more knowledgeable and informed lending professionals, a hypothesis certainly supported by the FREEandCLEAR Mortgage Survey.

Lenders are rightly expected to be highly knowledgeable about the mortgage process but it is still encouraging for borrowers to validate this point so emphatically. Working with an experienced, knowledgeable lender can make the difference between a closed loan or a frustrated borrower. The findings of the FREEandCLEAR Mortgage Survey suggest that most borrowers work with lenders that know what they are doing which is win-win for borrowers and lenders.

We will continue to provide a detailed analysis of each survey question on our blog in the coming weeks and you can review the full results from the FREEandCLEAR Mortgage Survey to better understand how borrowers think about and experience the mortgage process.

%