FREEandCLEAR Mortgage Survey: How Borrowers Select Mortgage Lenders

FREEandCLEAR is excited to released the second set of results from its ground-breaking Mortgage Survey. The latest results offer captivating insights into how borrowers select mortgage lenders.

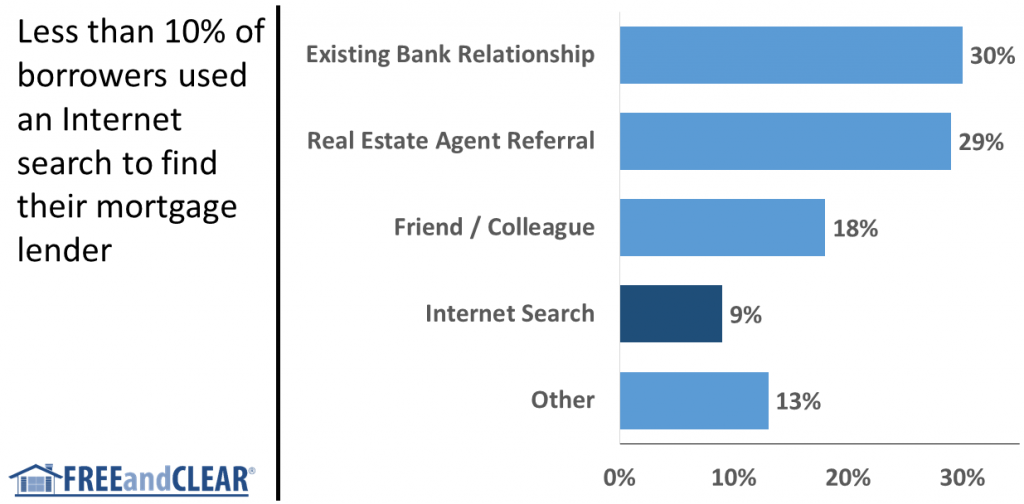

The survey examines key mortgage topics including how many lenders borrowers shopped when they got a mortgage, what types of lenders borrowers contacted and how borrowers found the lender they chose. Among the captivating findings: 77% of borrowers used an existing bank relationship, real estate agent or personal referral to find their mortgage lender while only 9% used an Internet search, showing that personal relationships trump the Internet when it comes to selecting a mortgage lender.

Less than 10% of borrowers used an Internet search to find their mortgage lender according to the FREEandCLEAR Mortgage Survey

The results also showed that 36% of borrowers compared only one lender and 64% compared two or less lenders when they got a mortgage, suggesting almost two thirds of borrowers may be leaving money on the table by not shopping lenders more extensively. You can view the latest survey results at FREEandCLEAR Mortgage Survey.

“Our mortgage survey continues to enable us to gather invaluable insights into borrower behavior” said FREEandCLEAR Co-Founder Michael Jensen. “These results enable us to really understand the factors that drive the borrower decision-making process.”

The survey reinforced some perceived notions about the mortgage industry while also producing some surprising findings. “We knew the mortgage market lagged other industries in terms of Internet adoption but we were shocked to see just how ‘old school’ the lender selection process is for most borrowers. It’s a significant opportunity for lenders and other industry participants” said Jensen.

Additional results of the FREEandCLEAR Mortgage Survey will be revealed in the coming months. Future releases of survey results explore important topics such as Borrower Education and Improving the Mortgage Process.

About FREEandCLEAR

FREEandCLEAR is a leading mortgage website that offers free tools and resources that empower people to find the mortgage that is right for them. FREEandCLEAR was developed by a father and son team who are on a mission to help people make better decisions and save money when they get a mortgage. Our valuable resources and mortgage rate tables put borrowers in control of the mortgage process and enable them to easily shop for a mortgage.

%