The 2017 tax reform bill, also known as the Tax Cuts and Jobs Act, is a monstrous piece of legislation — over 1,000 pages to be exact — that addresses many areas of the tax code. At FREEandCLEAR we are 100% focused on mortgages so we combed through the bill to determine how this monumental tax overhaul impacts mortgages and borrowers. Below we outline how the tax plan affects key items such as the mortgage tax deduction, home equity loan interest deduction and property tax deduction. In general, the legislation reduces the tax benefits attributable to having a mortgage but it is important for borrowers to read the fine print to understand exactly how the tax plan impacts them now and in the future.

The Tax Plan reduces mortgage and property tax benefits

Mortgage Interest Tax Deduction

Old Policy

Under the prior tax code, the interest expense on mortgage amounts up to $1,000,000 (or $500,000 if married filing separately) was tax deductible. The mortgage tax deduction applied to mortgages on first and second homes defined as qualified residences such as a house, condominium, cooperative, mobile home, house trailer or boat.

New Policy

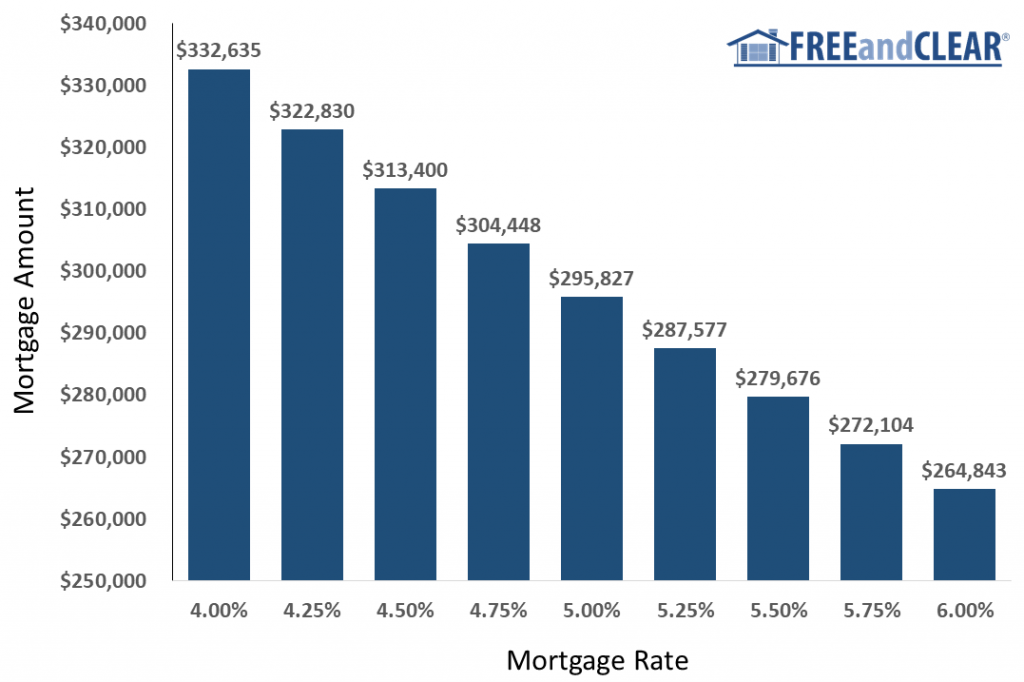

Under the new tax code, in most cases, for mortgages that close on or after December 15, 2017 the interest expense on loan amounts up to $750,000 (or $375,000 if married filing separately) is tax deductible. For example, if you take out a $1,000,000 mortgage to buy a home in 2018, you can only deduct the interest expense on $750,000 of the loan amount. Under the old tax code, you could deduct the interest expense on the full $1,000,000 mortgage amount.

For mortgages that closed before December 15, 2017, interest expense on mortgage amounts up to $1,000,000 (or $500,000 if married filing separately) remains tax deductible, so the mortgage tax deduction does not change.

The new mortgage tax deduction rules are effective for the 2018 tax year and still apply to mortgages on both first and second homes defined as qualified residences. The mortgage tax deduction policy is set to expire at the end of 2025.

Impact on Mortgage Borrowers

In short, if your mortgage closed before December 15, 2017, nothing changes as you can still deduct interest expense on up to $1,000,000 in mortgages on your primary and secondary residences. If your mortgage closed on or after December 15, 2017, you can only deduct interest on a maximum of $750,000 in mortgages (although there are certain exceptions to the December 15, 2017 deadline for rate and term refinances and for purchase mortgages on homes that were under contract prior to December 15, 2017 — see the Exceptions and Fine Print below).

The new, lower maximum loan amount that is eligible for the mortgage tax deduction should not impact the majority of borrowers who either do not itemize their tax deductions or whose mortgage amounts are below $750,000. On the other hand, the new policy reduces the tax benefit for borrowers looking to buy higher priced homes that require mortgages greater than $750,000. Depending on your interest rate and tax bracket, a borrower that obtains a $1,000,000 mortgage may lose $3,000 to $4,000 in mortgage tax deduction benefits under the new policy and maximum loan limit.

Exceptions and Fine Print

Please note that there are several exceptions to the December 15, 2017 mortgage closing deadline. First, if you have entered into a binding written contract before December 15, 2017 to close on the purchase of a principal residence before January 1, 2018, and the purchase is completed before April 1, 2018, the mortgage used to finance the purchase qualifies for the higher $1,000,000 mortgage limit. For example, if you signed a contract on December 1, 2017 to buy a home by January 1, 2018 and the purchase transaction closed on February 15, 2018, the mortgage used to finance the purchase is eligible for the old $1,000,000 mortgage tax deduction cap instead of the new $750,000 loan cap.

The second exception to the December 15, 2017 mortgage closing deadline is if you refinance a mortgage that closed prior to December 15, 2017. If you refinance a mortgage that closed prior to December 15, 2017, the higher $1,000,000 mortgage loan limit applies to your new mortgage as long as your new mortgage does not exceed your old mortgage. For example, if you refinance a $1,000,000 mortgage that you obtained in 2015, the $1,000,000 mortgage deduction limit applies to your new mortgage, as long as your new loan is not greater than your existing mortgage. In short, rate and term refinances of mortgages that closed prior to December 15, 2017 are eligible for the higher $1,000,000 mortgage limit while cash-out refinances are subject to the lower $750,000 mortgage limit.

Property Tax Deduction (also know as SALT Deduction)

Old Policy

Under the prior tax code, state, local and property taxes were deductible against your federal income taxes, which created a significant tax benefit for homeowners paying high property taxes.

New Policy

The tax plan permits a total of $10,000 in combined state and local tax (SALT) deductions, including property, income and sales taxes. The property tax deduction rule is effective for the 2018 tax year. The property tax deduction policy is set to expire at the end of 2025.

Impact on Mortgage Borrowers

The new, lower cap on property tax deductions (as well as state and local income and sales tax) should not impact the majority of borrowers who either do not itemize their tax deductions or who incur less than $10,000 in combined state and local property, income and sales taxes.

Borrowers who itemize their deductions and who pay higher state and local property, income and sales taxes may experience a significant reduction in their property tax deduction benefit. In addition to capping the property tax deduction at $10,000, the deduction now includes state and local income and sales taxes and not only property taxes, which you could previously itemize and deduct separately. For example, if you currently pay $5,000 in property tax and $12,000 in state income tax, you will only be able to deduct a total of $10,000 in combined property and state income taxes instead of the $17,000 in itemized property and state income taxes that you could deduct according to the prior tax code. The new tax policy adversely impacts people who live in states with higher home prices and property and income tax rates.

Exceptions and Fine Print

The new property tax and SALT tax deduction rules are clear and there are no exceptions. The $10,000 deduction limit applies to your combined expense for state and local property, income and sales taxes.

Home Equity Loan Tax Deduction

Old Policy

Under the prior tax code, the interest expense on home equity loans up to $100,000 (or $50,000 if married filing separately) was tax deductible.

New Policy

Contrary to popular belief, the interest expense on second mortgages, home equity loans and home equity lines of credit (HELOC) is still tax deductible as long as the loan is used to buy, build or substantially improve the property that secures the loan. Additionally, second mortgage, home equity loan and HELOC interest is tax deductible as long as the total amount of loans secured by the property does not exceed the value of the property and the total amount of the loans, including the first mortgage, does not exceed $750,000 (in most cases). For example, if you take out a second mortgage to purchase your primary residence, then the interest expense on the second mortgage is tax deductible. If you take out a second mortgage, home equity loan or HELOC and do not use the proceeds to buy, build or substantially improve your home, such to pay for a vacation, college tuition or to payoff credit card debt, then the interest expense on the loan is not tax deductible.

The interest expense on a second mortgage, home equity loan or HELOC for a second or vacation home is tax deductible as long as the loan is secured by the second or vacation home and the the total amount of the loans on your primary, second or vacation homes does not exceed $750,000. If you take out a home equity loan or HELOC on your primary residence to buy a second or vacation home, the interest expense on the home equity loan or HELOC is not tax deductible because the loan is not secured by the property it was used to purchase.

Impact on Mortgage Borrowers

The tax plan eliminates the $100,000 maximum loan amount for the home equity loan interest deduction which may enable borrowers to deduct more interest expense for larger home equity loans. On the other hand, the total amount of loans against a property including a first mortgage, second mortgage, home equity loan or HELOC cannot exceed $750,000, which may limit the tax deduction benefit. Additionally, the tax deduction benefit for a second mortgage, home equity loan or HELOC only applies if the loan proceeds are used to buy, build or substantially improve the property that secures the loan. So if you use the loan proceeds for a different purpose, the interest expense is not tax deductible according to the new tax law.

Exceptions and Fine Print

There was significant confusion about how the new tax law impacts the home equity loan interest expense tax deduction. In fact, the IRS published a note clarifying the issue due to numerous misinterpretations of the new law. While we outlined the new tax policy above, we recommend that borrowers consult a tax expert to understand how the home equity loan interest tax deduction applies to them.

FREEandCLEAR Resources