Many Borrowers Unaware of Low Down Payment Mortgage Programs

Saving enough money for a down payment is one of the biggest obstacles to buying a home, especially for first-time home buyers looking to crack the market. Over the past several years rising rents and relatively stagnant wage growth have magnified the down payment challenge and many prospective home owners remained locked out of owning a home. This dynamic helps explain why the homeownership rate in the U.S. continues to hover near a historical low and why first-time home buyers comprise a smaller portion of overall buyers as compared to the past 20 years.

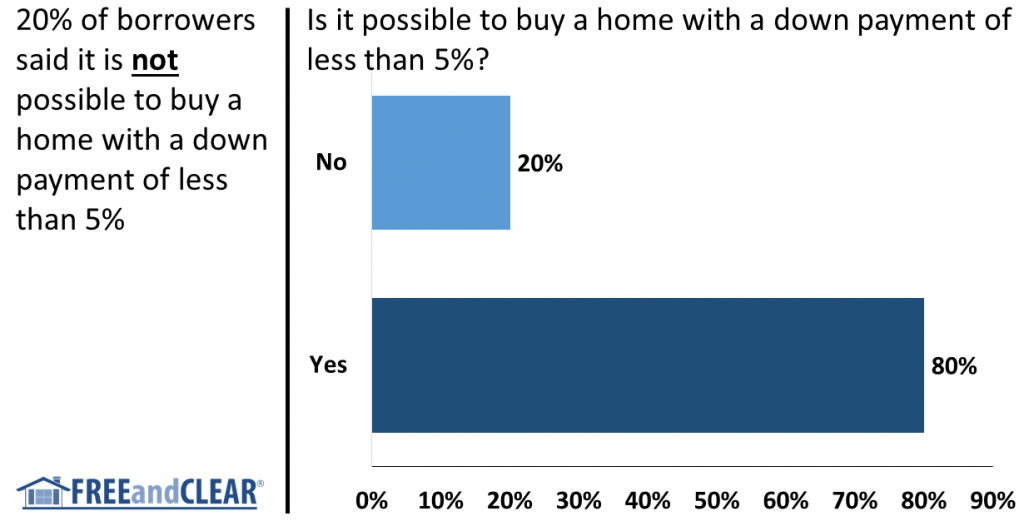

In light of these trends, mortgage programs that enable you to buy a home with little or no down payment should be gaining in popularity. It appears, however, that a significant portion of borrowers are unaware of the wide range of low down payment programs available to them. According to the FREEandCLEAR Mortgage Survey, 20% of borrowers said it is not possible to buy a home with a down payment of less than 5%. So one in five survey respondents may be missing out on home ownership assistance programs that significantly improve their ability afford to buy a home.

The question becomes, why are more borrowers not aware of these potentially helpful mortgage programs? There certainly is not a lack of no or low down payment mortgage programs including both government-backed and conventional options. On the government-sponsored side, the VA and USDA home loan programs enable eligible applicants to buy a home with no money down while the FHA mortgage program requires a down payment of 3.5% and the HUD Section 184 Program only requires a down payment of 2.25% (for loans above $50,000).

On the conventional side, the HomeReady and Home Possible mortgage programs only require a down payment of 3.0%, Fannie Mae also sponsors a standard 3.0% down program and a number of lenders even offer 1% down mortgage programs. Additionally, Bank of America, Chase, Citibank, Wells Fargo and numerous other lenders offer conventional mortgage programs that enable you to buy a home with a down payment of 3.0% to 5.0%. Given the countless options it is certainly surprising that many prospective home owners do not know that these programs exist.

Some borrowers might think that no or low down payment mortgage programs were eliminated when tighter lending standards were implemented following the mortgage crisis. Although new lending guidelines may make it more challenging to qualify for a mortgage, home buyer assistance programs remain a viable option for many borrowers. In fact, we have experienced an increase in the number of these programs over the past several years.

While it may be impossible to pinpoint why so may borrowers do not know about home ownership assistance programs it is clear that more needs to be done to educate prospective homeowners about the benefits of these programs. While each program has its pros and cons, including extra costs in some cases, they can be a highly valuable resource for people who think owning a home is out of reach. Increasing awareness of no and low down payment mortgage programs could help more people buy homes, which is good for both borrowers and lenders.

We will continue to provide a detailed analysis of each survey question on our blog in the coming weeks and you can review the full results from the FREEandCLEAR Mortgage Survey to better understand how borrowers think about and experience the mortgage process.

%