How Rising Mortgage Rates Affect How Much Home You Can Afford

Over the past several weeks, mortgage rates have increased .250% to .500%, depending on the loan program and lender, and have reached at a multi-year high. Although the Federal Reserve left interest rates unchanged at its January meeting, multiple rate hikes are anticipated over the course of 2018 as strong economic and labor market conditions stoke concerns about rising inflation.

Generally speaking, when the Fed raises interest rates it means the economy is doing well — unemployment is typically low and people are making more money — which is positive if you want to buy a home. The flip side of this positive economic news is that rising interest rates make it more challenging to afford a home. For many prospective buyers, buying a home feels like a moving target — you feel confident about your job, you are making more money, you are finally ready to buy a home — but then higher mortgage rates make it harder to qualify for a mortgage. But how much harder?

- Review current mortgage rates on FREEandCLEAR

Below, we use a borrower example to quantify how an increase in mortgage rates impacts what size mortgage you can afford. In this example, the borrower makes $60,000 a year, or $5,000 a month, in gross income (the median annual income in the United States is $59,000) and has $500 in monthly debt payments such as credit card, auto and student loans.

- Use our Mortgage Qualification Calculator to determine what size mortgage you can afford based on current mortgage rates

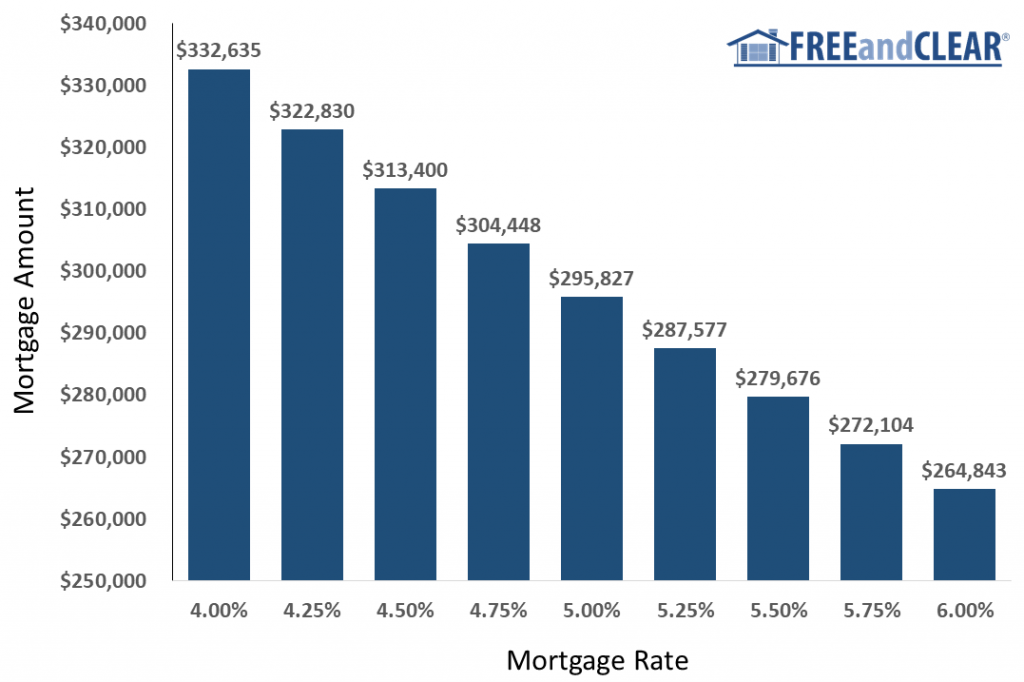

The chart demonstrates what size mortgage the borrower can afford based on various mortgage rates — the higher the mortgage rate, the lower the mortgage the borrower can afford. At a 4.000% mortgage rate, our example borrower can afford a $332,635 mortgage while at a 6.000% mortgage rate, the borrower can only afford a $264,843 mortgage. While we do not anticipate that mortgage rates will reach 6.000% this year, this example effectively illustrates how rising mortgage rates impact your ability to qualify for a mortgage.

Now let’s take this example one step further to understand how an increase in mortgage rates affects how much home you can buy. Using the same example scenario as above — a borrower with $5,000 in monthly gross income and $500 in monthly debt payments and a range of mortgage rates from 4.000% to 6.000% — the chart below shows what price home the borrower can afford, assuming the borrower makes a down payment of 20% of the property purchase. While it is certainly possible to buy a home with a lower down payment (check out these no or low down payment programs), a 20% down payment typically enables you to receive a lender’s lowest mortgage rate. The chart illustrates how rising mortgage rates reduce how much home you can buy. At a 4.000% mortgage rate, our example borrower can buy a $415,794 home while at a 6.000% mortgage rate, the borrower can only afford to buy a $331,054 home.

By this point, our analysis makes it pretty clear that higher mortgage rates do not help prospective home buyers, but let’s understand the issue from one more angle. Let’s say you have your heart set on buying your dream home. You found the home, you are ready to put in an offer and all you need to do is figure out ft you can afford the mortgage required to buy the home. In this example, your dream home costs $250,000 and you plan to make a 20% down payment ($50,000), which means you need a $200,000 mortgage. But can you afford the monthly payment? The answer to that question depends on the mortgage rate.

The chart below shows the monthly mortgage payment for a $200,000 mortgage based on different mortgage rates. The chart illustrates how rising mortgage rates increase your monthly mortgage payment. At a 4.000% mortgage rate, the monthly mortgage payment on a $200,000 30 year fixed rate mortgage is $955 while at a 6.000% mortgage rate, the monthly mortgage payment is $1,199. So depending on how much money our borrower makes, higher mortgage rates may push the dream home out of reach.

In light of this analysis it is important to highlight that it is impossible to predict mortgage rates. While most industry experts expect mortgage rates to increase in 2018, a host of economic events could produce a different outcome. Understanding how rising mortgage rates impact what size mortgage you can afford and home you can buy prepares prospective home buyers no matter what direction mortgage rates move.

%