Study Shows Getting Mortgage Quotes Saves You Money

At FREEandCLEAR we are strong advocates for shopping multiple lenders to find the lowest mortgage rate and best loan terms. Lowering your interest rate by just a small amount can save you hundreds or even thousands of dollars over the life of your mortgage and now there is a new study that proves it.

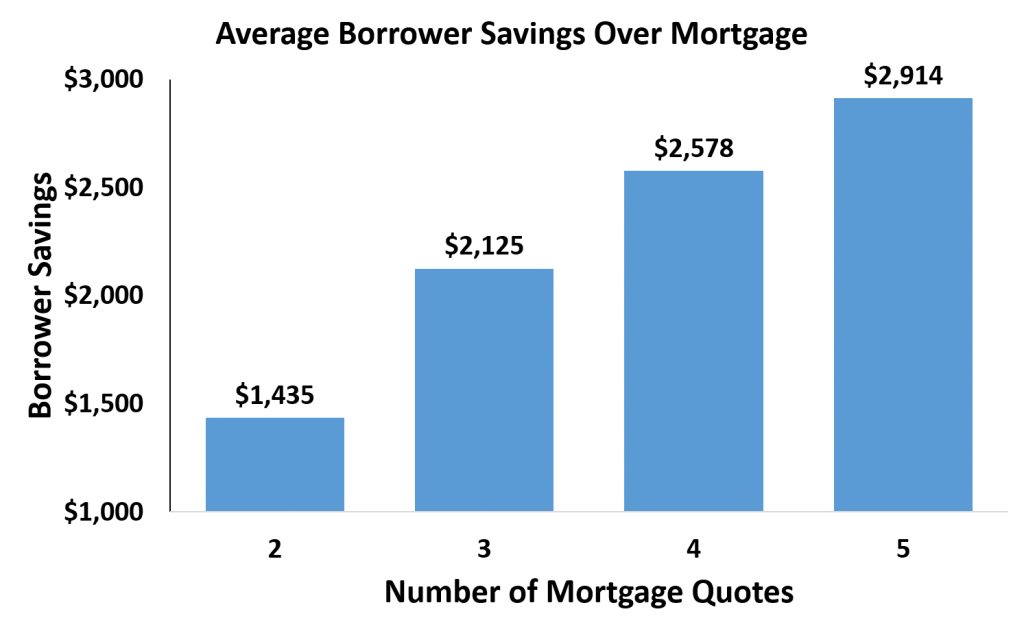

According to a report by mortgage industry leader Freddie Mac, borrowers can save an average of $1,435 by comparing two mortgage quotes and almost $3,000 by comparing five mortgage quotes. Freddie Mac is not a lender but rather buys loans from lenders and helps shape mortgage policy. It is an important and impartial player in the mortgage industry which makes the report all the more meaningful. The findings of the study reinforce that just like any other product, shopping for a mortgage and comparing several lenders saves you money.

The chart below shows the average borrower savings depending on the number of mortgage quotes you compare. The more quotes you compare, the more money you save on your mortgage.

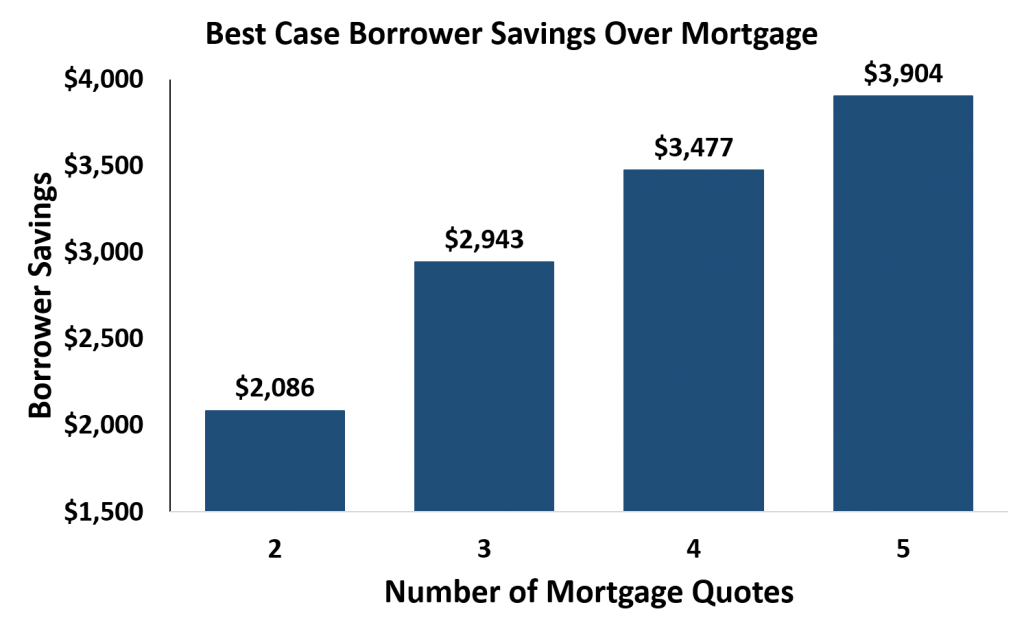

It is important to highlight that the above analysis is based on a $250,000 loan amount. The larger the mortgage, the more money you save and vice versa. Another point to emphasize is that the chart above shows the average borrower savings and your actual savings may be much higher. The chart below reflects more of a best case scenario when you compare mortgage quotes — basically how much money borrowers would save if they compared lenders offering the lowest mortgage rates among the thousands of lender options.

Best case scenario borrower savings based on number of mortgage quotes (90th percentile; source: Freddie Mac)

As the above chart demonstrates, borrowers that shop lenders that offer lower mortgage rates save even more money over the life of their loan. In this best case, borrowers that compare two lenders save $2,086 while borrowers that get five mortgage quotes save a whopping $3,904. Again, this analysis is for a $250,000 mortgage and you save more with a higher loan amount. The study is valuable because it quantifies how much money borrowers save when they shop for a mortgage as well as how much money they leave on the table by not shopping.

In light of how much money is at stake you would think that everyone shops for a mortgage but unfortunately that is not the case. According to a recent survey by FREEandCLEAR, 36% of mortgage borrowers said they only received one mortgage quote when they got a mortgage. That means over a third of borrowers failed to shop multiple lenders which could end up costing them thousands of dollars over the course of their mortgage.

The question becomes why don’t people shop for a mortgage? After all, people shop multiple stores to find the best deal on a television and multiple dealerships to find the lowest price on a car. How come this approach does not apply to mortgages as well?

There are several factors including the complexity of the mortgage process and the tight time frame many borrowers are under when they buy a home or refinance. Additionally, most people only get a mortgage a handful of times during their lifetime so they may not be accustomed to comparing mortgage quotes like they would compare airline ticket prices.

These days, however, it is easier and faster than ever to shop for a mortgage so there are no excuses for borrowers. Our Personalized Mortgage Quote form enables you to receive free quotes from multiple lenders based on your specific situation.

You can also compare mortgage rates and fees for lenders without providing any personal information by using our lender tables. Our lender tables feature updated rates for multiple lenders and enable you to customize your mortgage shopping based on loan amount, loan-to-value (LTV) ratio, term, program and other factors.

Whether you use the resources available on FREEandCLEAR or another service, we highly recommend that you compare multiple quotes before selecting a lender. As the Freddie Mac study underscores, a little shopping goes a very long way when you get a mortgage.

%