Education System Fails Mortgage Borrowers

Although a mortgage is one of the biggest financial commitments most people make, many borrowers are undereducated or misinformed about the mortgage process. One of the primary reasons borrowers find the mortgage process challenging and overwhelming is because they do not learn about it in school, at any level. The results of the FREEandCLEAR Mortgage Survey reinforce how little financial literacy education students receive in our education system, especially as it pertains to important topics such as mortgages.

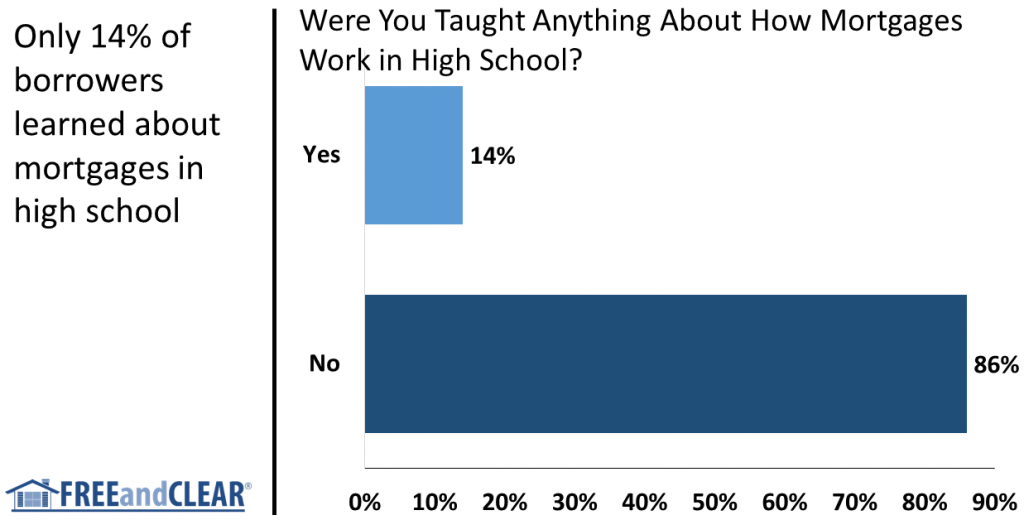

According to the FREEandCLEAR Mortgage Survey, only 14% of borrowers said they learned about the mortgage process in high school. Or in other words, 86% of borrowers did not learn about mortgages in high school.

While high school students are usually several years away from getting a mortgage to buy a home, the lack of education is eye-opening. Teaching people about mortgages at an earlier age empowers them to make better decisions when they apply for a loan in the future. Being more knowledgeable about the mortgage process also makes people less susceptible to scams and fraud, which can save them thousands of dollars and reduce financial hardship. Additionally, improved financial literacy education in high school can help borrowers understand how the decisions they make when they are young, such as overusing a credit card, can impact their ability to qualify for a mortgage in the future.

The mortgage education picture does not look much better when you look at college. According to the FREEandCLEAR Mortgage Survey, only 17% of borrowers said they learned about the mortgage process in college, a figure that is only slightly better than high school education rate. So less than one in five borrowers are taught, or elect to learn, about mortgages in college, which is shockingly low.

Most borrowers spend the majority of their adult lives paying their mortgage yet spend almost no time learning about mortgages in high school or college. At FREEandCLEAR we often come across incredibly bright, highly-educated people who struggle to understand the mortgage process because so little attention is paid to it in high school or college classrooms. In many cases, borrowers are learning about the mortgage process for the first time when they apply for a loan and they may not have access to knowledgeable education resources. Knowledge is power so perhaps that is why so many people feel powerless when it comes to getting a mortgage — a lesson that we painfully experienced as a country in the aftermath of the real estate crisis less than ten years ago.

We recognize that the U.S. education system is under strain at all levels and is certainly not responsible for teaching all subjects. But for something as important as financial literacy and mortgages, a little education can make a huge difference.

We will continue to provide a detailed analysis of each survey question on our blog in the coming weeks and you can review the full results from the FREEandCLEAR Mortgage Survey to better understand how borrowers think about and experience the mortgage process.

%